TABLE OF CONTENTS

OBJECTIVES OF THE REPORT

EXECUTIVE SUMMARY

BACKGROUND

ECONOMIC GROWTH AND OIL DEMAND IN ASIA

U.S. CRUDE OIL PRODUCTION

U.S. CRUDE OIL EXPORTS

U.S. GULF COAST INFRASTRUCTURE

MARKET ENVIRONMENT

ASIAN CRUDE OIL IMPORTERS

U.S. GULF COAST CRUDE OIL EXPORTERS

U.S. GULF COAST CRUDE OIL PRICING STRUCTURE

REGRESSION MODELS FOR U.S. GULF COAST CRUDE EXPORTS

REFINING VALUE ANALYSIS METHODOLOGY

REFINING VALUE

FREIGHT COSTS PROJECTIONS AND OUTLOOK FOR MARINE BUNKERS

CRUDE OIL COMPARISON

REFINING OVERVIEW OF POTENTIAL MARKETS

MODELLING REFINERY CONFIGURATIONS

“STUDY MARKET” AND “BROAD MARKET” FOR U.S. CRUDE EXPORTS

PLANT GATE AND NETBACK REFINING VALUES

CONCLUSIONS

APPENDICES

1 – KEY UNCERTAINTIES IN BUNKER FUELS OUTLOOK

2 – CRUDE OIL SULFUR AND SPECIFIC GRAVITY

3 – REFINING VALUES AND FREIGHT PROJECTIONS

4 – REFINING CONFIGURATION

5 – SHIPPING DISTANCES

6 – CRUDE OIL PIPELINES, EXISTING / PLANNED

7 – BRENT AND PRODUCT CRACKS ASSUMPTIONS

8 – BASE CASE SUMMARIES

TABLES

1 Economic Growth in Asia and Other Regions

2 Regional Oil Consumption

3 Shares of Incremental Demand: Asia, China, and India

4 U.S. Crude Oil Production

5 Regional U.S. Crude Export Destinations

6 Freight Cost U.S. Gulf Coast to Singapore, Rotterdam, and Eastern Canada

7 2016 Key Asian Crude Imports by Region

8 U.S. Crude Exports to Asian Destinations

9 Historical Average Crude Price Differential vs. WTI

10 Relationship Between Dubai and Brent, Swaps, and Physical Contracts

11 Regression Results Based on Monthly Data – January 2016 – February 2018

12 Refinery Capacity and Utilization Outlook

13 Overview of Potential Markets for U.S. Gulf Coast Crude

14 2017 Refining Process Capacities in Asia and Europe

15 Modelled Crude Processing Capability – Refinery Overview

16 Crude Process Capability

17 WTI-Midland Netback RV vs. Brent 2018 by Refinery Configuration

18 API and Sulfur Characteristics for Three Sweet Crudes

19 2018 Breakeven RV WTI-Midland vs. Qua Iboe

20 WTI-Midland Netback RV Less Dated Brent

21 U.S. Major Export Crude Characteristics

22 Plant Gate Refining Values Minus Dated Brent

23 Freight Projections

24 Netback Refining Value Minus Dated Brent

25 Refinery Configuration Details

26 Shipping Distances Between Major Ports and Asian Destinations

27 Permian Basin Crude Pipeline Capacity

28 Forecast Product Cracks vs. Dated Brent

29 Reliance India Base Case Refinery Charge and Yield

30 Singapore Aggregate Base Case Refinery Charge and Yield

31 North China High Conversion Base Case Refinery Charge and Yield

32 North China Medium Conversion Base Case Refinery Charge and Yield

33 South Korea Medium Conversion Base Case Refinery Charge and Yield

34 Japan High Conversion Base Case Refinery Charge and Yield

35 Japan Medium Conversion Base Case Refinery Charge and Yield

36 Europe Cracking Base Case Refinery Charge and Yield

37 Eastern Canada Base Case Refinery Charge and Yield

FIGURES

1 U.S. Crude Oil Supply

2 U.S. Crude Oil Production Forecast by Region

3 Weekly Exports of U.S. Crude Oil

4 U.S. Crude Exports by Region January 2016 – July 2018

5 Quarterly Regional Market Shares of U.S. Crude Exports

6 Country Shares for U.S. Crudes Exported to Asia

7 Discount of WTI-Midland to WTI-Houston

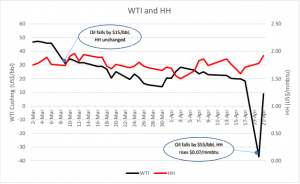

8 U.S. Crude Exports and WTI Price Differentials

9 Sour Crude Differentials to WTI-Cushing

10 Monthly Average WTI Differentials – Houston/Cushing/Midland August 2018

11 Major Export Markets for U.S. Gulf Coast Crudes

12 China’s Coastal Refineries

13 Japan’s Refineries

14 South Korea’s Refineries

15 India’s Refineries

16 Singapore’s Refineries

17 Northwest Europe’s Refineries

18 2018 Light Crude Tier Volumes – Study Market

19 2018 Light Crude Tier Volumes – Broad Market

20 2018 Plant Gate RV vs. WTI-Midland

21 Bonny Light vs. WTI-Cushing FOB Price Basis

22 Discount of NYMEX WTI vs. WTI-Houston

23 Change in Plant Gate RV vs. WTI-Midland 2020 / 2018

24 Change in Plant Gate RV vs. WTI-Midland 2025 / 2020

25 2018 Netback RV vs. WTI-Midland

26 2018 Dubai Plant Gate RV vs. Mars

27 2018 Dubai Netback RV vs. Mars

28 Dubai-Mars FOB Price Differential

29 Change in Dubai vs. Mars Plant Gate RV 2020 / 2018

30 Change in Dubai vs. Mars Plant Gate RV 2025 / 2020

31 2018 WTI-Midland Netback Value vs. Study Market Volume

32 2018 WTI-Midland Netback RV Curve vs. Broad Market Volume

33 2020 WTI-Midland Netback Value vs. Broad Market Volume

34 2025 WTI-Midland Netback Value vs. Broad Market Volume

35 World Crude Oil Proved Reserves

36 IMO MARPOL Annex VI Marine Bunker Fuel Sulfur Content

37 MARPOL Annex VI Compliance

38 Quality Specifications of Major Crudes