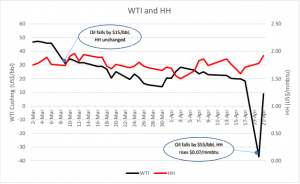

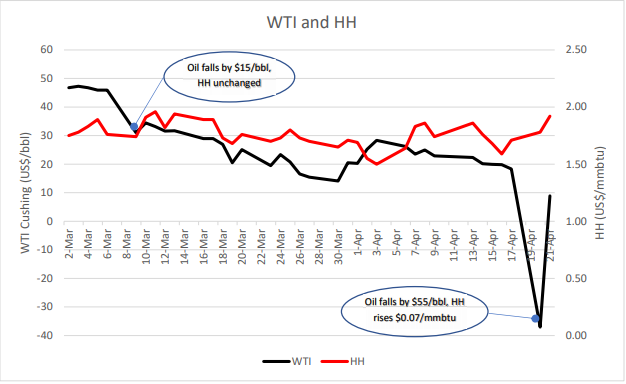

A lot has been written about the sudden and stunning fall of the WTI oil price into negative territory on Monday April 20th, and rightly so, as the oil markets have never had prices enter negative territory. These are truly exceptional times, when the entire energy industry and supply chain has been subjected to stresses that were never foreseen nor anticipated.

One very interesting issue for the markets is how steady the natural gas price at the Henry Hub (HH) stayed during this period. In fact, while oil prices have plunged during April, natural gas prices have actually strengthened.

This unusual behavior is driven by a number of factors.

On the oil side, demand has fallen very significantly, while the ongoing OPEC+ disagreement has resulted in additional oil entering the markets, at least until they finally came to a resolution to restrain production. During this timeframe, the COVID 19 response, and the stay at home orders and lessened transportation needs, has significantly reduced the demand for transportation fuels. The in turn has lowered demand for crude oil, especially as refineries are running at lower utilization and even shutting down completely.

However, natural gas demand, with electricity as a large driver, has actually increased year on year. Whilst industrial demand has fallen by 1.7bcf/d, according to the latest EIA report, exports to Mexico and LNG exports have increased by 3.6 bcf/d. This has helped support the price of natural gas.

Much of the natural gas produced in the United States is associated gas, meaning that it is co-produced with the crude oil. While producers may soon stop drilling, and possibly even shut in existing wells, this will lower future production of natural gas. Since market demand for the gas is still strong, the lowered production (supply) will act as a floor to support and strengthen natural gas prices. So, it is interesting that lowered crude oil production in the United States may actually help to support natural gas prices.

The crude oil price collapse can also be explained by the fact that crude oil storage is nearing its limits at Cushing. Crude oil producers don’t have any place to store the crude oil. This has especially affected the futures markets, as those traders who don’t also own storage have to settle their futures contract in order to not be forced to take delivery of the oil. Natural gas, is not facing any storage issues especially as we are at the end of the winter withdrawal season.

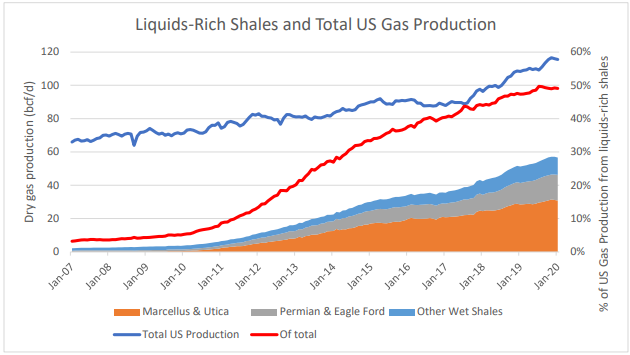

Production of natural gas from oil and liquids-rich shale plays accounts for just under half of total US gas production, according to EIA data for January. Thus, the incentives to production are also linked to the oil price.

For natural gas, the amounts of gas coming from oil formations as associated gas or liquids-rich wet shales is significant. Therefore, one may expect that if the oil price is lower, there will be less associated gas and less total gas being produced in the future as oil prices remain low. Fifty percent of total US gas production already comes from these liquids-rich shales such as the Permian and Eagle Ford in Texas, and the Utica and Marcellus in Appalachia.

This then explains the rise in HH prices while WTI collapsed. Gas consumption is expected to be relatively stable while gas production is expected to fall due to less associated gas and lower productions from liquids-rich shales.